Just a few days ago I was in Greece. Although I was there to promote a remarkable chess in schools initiative of the Stavros Niarchos Foundation and the Kasparov Chess Foundation, many of the questions at the press conference were about Greece, the European Union, and Putin’s Russia. While I have discussed the Greek crisis with many economists and politicians, my opinions are based on the values of capitalism and democracy. For capitalism to work, there must be consequences for bad decisions. No company, no nation, can be “too big to fail” or there is no reason to make wise decisions. Indeed, it punishes those who did make wise decisions in the first place.

Just a few days ago I was in Greece. Although I was there to promote a remarkable chess in schools initiative of the Stavros Niarchos Foundation and the Kasparov Chess Foundation, many of the questions at the press conference were about Greece, the European Union, and Putin’s Russia. While I have discussed the Greek crisis with many economists and politicians, my opinions are based on the values of capitalism and democracy. For capitalism to work, there must be consequences for bad decisions. No company, no nation, can be “too big to fail” or there is no reason to make wise decisions. Indeed, it punishes those who did make wise decisions in the first place.

So it’s sad to see prominent econ-pundits like Paul Krugman and Jeffrey Sachs hailing the Greek vote and inevitable default as a good result and a “victory for democracy”. Democracy is more than just a vote; it’s a process that depends on a rule of law that applies to all. If the rules can change on a whim, and if everyone cannot believe in a fair system, the vote is little more than anarchy or, as in Putin’s Russia, a charade to mask repression and dictatorship. Without the rule of law, the purest expression of democracy is a lynch mob.

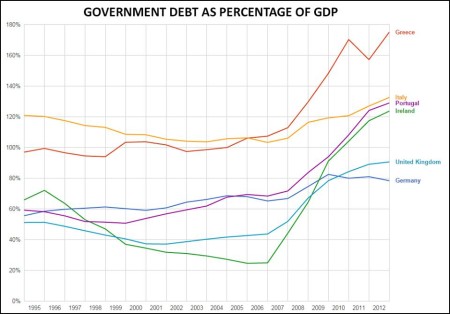

Greece arrived at the Euro buffet and filled its plate with every dish and then came back for dessert. Twice! Then they found out the meal wasn’t free and that they didn’t have the money to pay the check. So they borrowed and borrowed some more and still didn’t leave the buffet until dragged away. It was a very poor investment by the lenders and a criminally stupid series of decisions by the borrowers. Both deserve the punishment capitalism metes out for such gluttony. If not, what happens in Italy, Ireland, and Portugal, where debt levels are also sky high? Telling them there is no reason to worry, that there is no reason to change because there is always another bailout, another extension? That is a recipe for more long-term catastrophes like the one we are seeing in Greece. (It’s not on the chart, but the US is now 100% of debt as GDP.)

No one wants anyone to suffer. But bad decisions, lies, and delays are the real cause of suffering, not austerity. To make a more prosperous world we need a functioning system, not one that says free money can solve all our problems. How much of the trillions of dollars the US, EU, and Japan have printed and pumped with quantitative easing ended up in Greek bonds? How much in Puerto Rico? Easy money requires discipline and we are seeing what happens when that discipline fails.

There are many complex discussions to be held about whether or not Greece should ever have joined the monetary union, should be in it now, or whether it was a good idea in the first place. But I am convinced that this crisis isn’t a failure of capitalism or democracy. It is our politicians who have failed capitalism by twisting its principles and trying to turn it into a perpetual money machine. There will be many more such catastrophes as long as we follow these fake values that tell us that self-control, sacrifice, and risk-taking are obsolete.